Audited financial statements are a cornerstone of transparency and accountability in the business world, leading us into a fascinating exploration of their significance. These statements not only provide a clear picture of a company’s financial health but also build trust among stakeholders, ensuring that accurate information is presented to investors and regulators alike.

In this discussion, we’ll delve into the auditing process, the role of finance professionals, and how these statements impact various sectors. From understanding the key components that constitute audited financial statements to exploring the relevance of finance licenses, we will cover a comprehensive landscape of related topics that enhance our grasp of the finance domain.

Understanding Audited Financial Statements

Audited financial statements play a crucial role in the financial landscape of businesses. They serve as a verification mechanism that provides stakeholders with confidence in the accuracy and reliability of financial reports. By understanding these statements, investors, creditors, and other interested parties can make well-informed decisions.The auditing process involves a comprehensive examination of a company’s financial statements by external auditors.

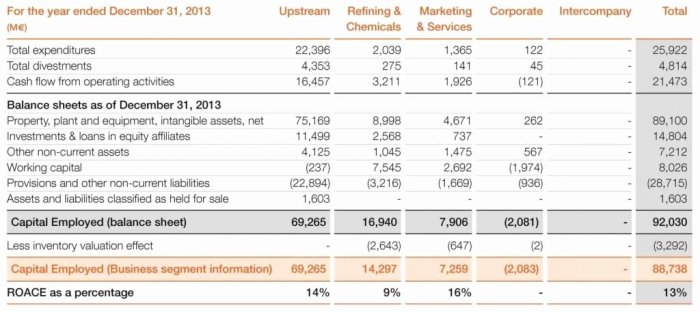

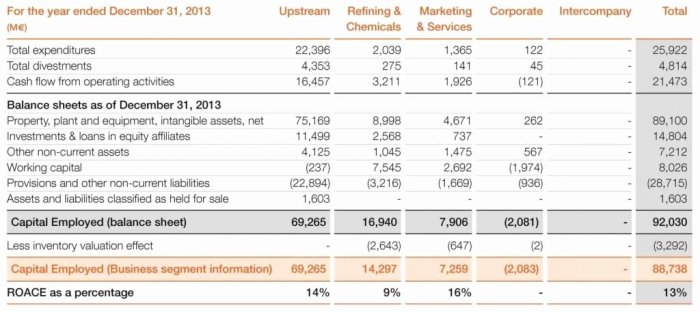

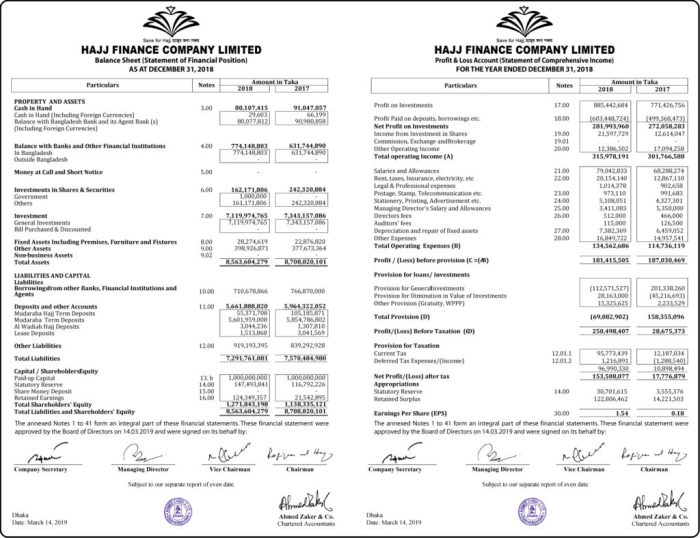

These auditors assess whether the statements are presented fairly in accordance with established accounting standards. Their role extends beyond just verifying numbers; they analyze internal controls and compliance with regulations to ensure accurate reporting. Key components of audited financial statements include the balance sheet, income statement, statement of cash flows, and the notes to the financial statements, each providing distinct insights into a company’s financial health.

The Role of Finance Licenses

In the finance industry, possessing the right licenses is essential for professionals aiming to advance their careers. Different finance licenses cater to various specializations, ensuring that individuals meet regulatory requirements to practice in specific areas.Obtaining finance licenses not only validates a professional’s expertise but also enhances their credibility in the industry. For instance, licenses such as Certified Public Accountant (CPA), Chartered Financial Analyst (CFA), and Financial Risk Manager (FRM) provide significant advantages in career progression and job opportunities.

Each type of finance license corresponds to different career paths; for example, CPAs focus on auditing and tax, while CFAs deal with investment management.

The Function of a Finance Lawyer

Finance lawyers play an integral role in the realm of audited financial statements. Their primary responsibilities include advising clients on compliance with financial regulations and assisting in the interpretation of complex financial documents.By helping clients understand audited financial statements, finance lawyers ensure that they are aware of their rights and obligations. Legal issues can arise frequently in financial reporting, such as misrepresentation, fraud, or regulatory violations.

For instance, if a company significantly exaggerates its revenue figures, it can lead to legal ramifications for both the business and its executives.

Career Opportunities in Finance

The finance sector is rich with career opportunities that require a solid understanding of audited financial statements. Here’s a list of some popular finance careers:

- Auditor

- Financial Analyst

- Compliance Officer

- Tax Consultant

- Investment Banker

To succeed in these roles, professionals must possess a range of skills, including analytical thinking, attention to detail, and proficiency in financial software. Additionally, emerging careers influenced by technology, such as data analysts and forensic accountants, show a growing trend towards integrating audit principles with innovative technologies.

Key Finance Companies Involved in Auditing

When it comes to auditing services, several prominent finance companies are recognized for their reliability and reputation. Below is a comparison table of major auditing firms:

| Company | Reputation | Services Offered |

|---|---|---|

| Deloitte | Highly reputable with a global presence | Audit, Consulting, Tax Advisory |

| PwC | Strong emphasis on transparency and integrity | Audit, Assurance, Tax Services |

| EY | Recognized for innovative audit solutions | Assurance, Advisory, Tax Services |

| KPMG | Known for sector-specific expertise | Audit, Tax, Advisory |

These firms significantly influence the auditing process, as their methodologies and standards set benchmarks for the industry. Their dedication to quality and adherence to regulations fosters trust among stakeholders.

Basics of Finance Related to Auditing

Understanding the fundamentals of finance is crucial for interpreting financial statements accurately. Key principles include the concepts of accrual accounting, the matching principle, and the importance of liquidity.A solid grasp of basic financial concepts such as assets, liabilities, equity, revenue, and expenses is essential for anyone working in finance. These principles enable professionals to better understand the context and implications of audited financial statements, ensuring informed decision-making.

The Role of the Finance Division

The finance division within an organization serves multiple essential functions, including budgeting, forecasting, and financial reporting. This division is pivotal in preparing audited financial statements, as it ensures that all financial data is accurately recorded and reported.By actively contributing to the preparation of audited financial statements, the finance division enhances organizational transparency. This openness fosters trust among stakeholders and can lead to improved relationships with investors and regulatory bodies.

Responsibilities of the Finance Minister

Finance ministers hold significant responsibilities in establishing regulations governing financial reporting. Their role involves creating frameworks that ensure the integrity of financial reporting practices across the country.Government policies significantly impact how financial statements are audited. Different countries may have varying regulations, which requires finance ministers to adapt their approaches to ensure compliance. For instance, in the U.S., the Sarbanes-Oxley Act imposes strict auditing requirements, whereas other nations may have more lenient standards.

Finance Transformation and Technology

Technology is rapidly transforming the audit processes involved in reviewing financial statements. Innovations such as data analytics, artificial intelligence, and blockchain are enhancing the quality and efficiency of audits.These advancements lead to significant implications for audit practices, allowing for more thorough analyses and quicker resolutions of discrepancies. Examples of finance technologies that are reshaping auditing include automated data extraction tools and advanced analytical software, which streamline the auditing process and improve accuracy.

Understanding Finance Strategy

A well-defined finance strategy is crucial for the preparation of audited financial statements. This strategy helps organizations align their financial goals with their overall business objectives, ensuring that financial reporting reflects the true state of the organization.Strategic financial planning has profound implications for auditing practices. By incorporating audit considerations into their finance strategy, organizations can enhance their internal controls and minimize risks associated with financial reporting.

The Role of a Finance Specialist

Finance specialists focused on audits must possess specific qualifications and skills, including expertise in accounting principles, analytical skills, and a strong understanding of regulatory requirements. Their role is vital in ensuring that financial reports are accurate and compliant with applicable standards.These specialists frequently perform tasks such as conducting internal audits, preparing financial reports, and advising on compliance issues. Their expertise is crucial in maintaining the integrity of financial reporting and safeguarding the organization’s financial health.

Ultimate Conclusion

In summary, the intricate world of audited financial statements reveals their crucial role in fostering trust and accountability within the business ecosystem. As we’ve explored, these documents are not just numbers on a page; they embody the efforts of professionals working diligently to ensure accuracy and compliance. Embracing the importance of audits will not only benefit organizations but will also empower individuals seeking careers in finance.

Query Resolution

What are the main purposes of audited financial statements?

The primary purposes are to provide assurance about the reliability of financial statements, enhance credibility with stakeholders, and comply with regulatory requirements.

Who conducts audits of financial statements?

Independent auditors, typically certified public accountants (CPAs), conduct audits to ensure objectivity and impartiality in the evaluation of financial statements.

How often should companies have their financial statements audited?

Companies should have their financial statements audited annually, although some may require more frequent audits based on industry regulations or stakeholders’ requests.

What is the difference between internal and external audits?

Internal audits are conducted by an organization’s own staff to assess internal controls, while external audits are performed by independent auditors to evaluate the accuracy of financial statements.

Can audited financial statements be manipulated?

While auditors strive to detect fraud and errors, it is still possible for companies to manipulate financial statements through dishonest practices, which is why strong internal controls are essential.