Strategic financial management stands as a pillar in the realm of business, guiding organizations toward their financial goals with precision and insight. By intertwining financial acumen with strategic planning, businesses can navigate the complexities of today’s economic landscape, ensuring sustainability and growth.

At its core, strategic financial management involves defining clear financial objectives, allocating resources effectively, and making informed decisions that align with organizational goals. It encompasses a range of practices, from understanding financial statements to the intricacies of finance licenses, and plays a crucial role in shaping the future of businesses.

Introduction to Strategic Financial Management

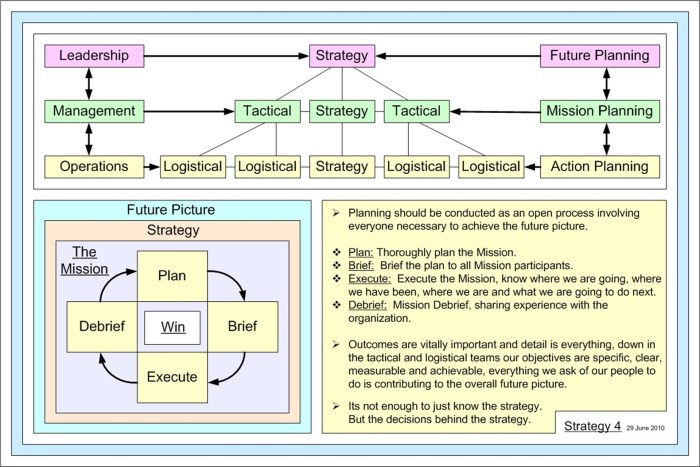

Strategic financial management is a fundamental aspect of any business that aims to align financial practices with the overarching goals of the organization. It encompasses the planning, directing, monitoring, organizing, and controlling of the monetary resources of an organization to achieve its strategic objectives. The importance of strategic financial management lies in its ability to provide a framework for decision-making that enhances profitability, sustainability, and growth.The role of strategic financial management in achieving organizational goals cannot be understated.

It serves as a roadmap that guides businesses in allocating resources efficiently, managing risks, and exploring new opportunities. By integrating financial goals with business strategies, organizations can prioritize investments and enhance their competitive advantage. The key components of strategic financial management include financial planning, capital budgeting, risk management, and performance evaluation.

Financial Licenses and Their Role

Understanding the significance of financial licenses is crucial for professionals in the finance sector. Financial licenses grant individuals and firms the legal authority to conduct various financial activities. Different types of financial licenses exist, including those for brokers, investment advisors, and insurance agents, each serving specific functions within the finance industry.Obtaining a finance license typically involves meeting certain educational and professional requirements, including passing examinations and undergoing background checks.

The process may vary based on the type of license and the jurisdiction in which one operates. Having a finance license often positively impacts career advancement in financial management, as it demonstrates a level of expertise and compliance with regulatory standards.

The Role of Finance Lawyers

Finance lawyers play a critical role in the intersection of finance and law. Their functions include advising businesses on legal compliance, drafting and negotiating contracts, and representing clients in financial disputes. The responsibilities of finance lawyers extend to ensuring that financial management decisions are legally sound, which minimizes the risk of litigation and penalties.The legal implications of financial management decisions can be far-reaching.

Finance lawyers help businesses navigate complex regulations such as the Securities Act and the Dodd-Frank Act, ensuring adherence to financial laws that govern transactions and corporate practices. By understanding these regulations, finance lawyers support organizations in making informed financial decisions that align with legal frameworks.

Becoming a Finance Professional

Embarking on a career in finance requires a combination of education and experience. Typically, aspiring finance professionals pursue degrees in finance, accounting, or business administration. Advanced degrees, such as an MBA or a Master’s in Finance, can further enhance one’s qualifications and career prospects.Essential skills required for success in finance careers include analytical thinking, attention to detail, and proficiency in financial modeling.

Additionally, strong communication skills are crucial for conveying complex financial concepts to stakeholders. Various finance certifications, such as CFA (Chartered Financial Analyst) and CPA (Certified Public Accountant), offer professionals credibility and a competitive edge in the marketplace.

Overview of Finance Companies

Finance companies play a pivotal role in the economy by providing various financial services, such as loans, credit, and investment opportunities. These companies can be categorized into several types, including consumer finance companies, commercial finance companies, and investment firms, each offering distinct services tailored to specific market needs.The role of finance companies in strategic financial management is significant as they facilitate access to capital, enabling businesses to fund operations and growth initiatives.

Successful finance companies, such as Goldman Sachs and JPMorgan Chase, implement diverse strategies to remain competitive, including technological innovation and a focus on customer experience.

Finance Basics

Understanding the fundamental concepts and principles of finance is essential for effective strategic financial management. Key concepts include time value of money, risk and return, diversification, and the principle of capital allocation. These principles guide financial decision-making and investment strategies.Financial literacy is vital for professionals involved in strategic financial management. It equips them with the knowledge to interpret financial data, assess risks, and make informed decisions.

Essential financial terms include:

- Assets: Resources owned by a company that have economic value.

- Liabilities: Obligations that a company owes to outside parties.

- Equity: The residual interest in the assets of a company after deducting liabilities.

- Revenue: The total income generated from business operations.

- Expenses: The costs incurred in the process of earning revenue.

Structure of a Finance Division

A typical finance division within an organization is structured to optimize financial management processes. It often includes several key roles: Chief Financial Officer (CFO), financial analysts, accountants, and treasurers. Each of these roles comes with distinct responsibilities that contribute to the overall financial health of the organization.The interrelations of a finance division with other departments, such as marketing, operations, and human resources, are crucial for cohesive organizational functioning.

Effective collaboration ensures that financial insights inform strategic decisions across the board, ultimately driving organizational success.

The Role of a Finance Minister

A finance minister holds significant responsibilities in shaping national economic policy. This role involves overseeing the government’s financial system, including budgeting, taxation, and public spending. Finance ministers influence strategic financial management at the governmental level by implementing policies that drive economic growth and stability.Examples of significant policies initiated by finance ministers include tax reforms, fiscal stimulus packages, and regulatory changes aimed at enhancing financial markets.

These policies can have profound effects on the economy, businesses, and individuals alike.

Finance Transformation in Organizations

Finance transformation refers to the process of reimagining and enhancing financial management practices within organizations. The objectives of finance transformation include improving efficiency, leveraging technology, and fostering a culture of continuous improvement.Implementing finance transformation involves several steps, such as assessing current processes, identifying areas for improvement, and adopting new technologies like automation and data analytics. Successful case studies, such as those from multinational corporations, showcase how finance transformation initiatives have led to increased operational efficiency and better decision-making capabilities.

Exploring Finance Jobs

The finance sector offers a diverse array of job roles, including financial analyst, investment banker, accountant, and risk manager. Each role requires specific skills and expertise tailored to the demands of the position.Skills required for different finance jobs vary but often include quantitative analysis, strategic thinking, and proficiency in financial software. Job market trends indicate a growing demand for finance professionals, particularly those with experience in data analytics and technology integration, as organizations continue to adapt to an evolving financial landscape.

The Impact of Finance Technology

The evolution of finance technology, also known as fintech, has transformed financial management practices. Innovations in this field have led to more efficient processes, enhanced customer experiences, and improved access to financial services.Key financial technologies revolutionizing the industry include blockchain, artificial intelligence, and mobile payment systems. Organizations leveraging these technologies can gain a strategic advantage by streamlining operations and enhancing decision-making capabilities.

Understanding Financial Statements

Financial statements serve as essential tools for assessing a business’s financial health. The purpose of key financial statements, such as the balance sheet, income statement, and cash flow statement, is to provide a comprehensive overview of a company’s financial performance.Analyzing financial statements requires a solid understanding of the components, including assets, liabilities, revenues, and expenses. This analysis aids in strategic decision-making by highlighting trends and informing future financial strategies.

The Role of a Finance Specialist

Finance specialists possess expertise in specific areas of finance, such as investment analysis, tax planning, or risk management. Their functions include conducting financial research, providing recommendations, and assisting organizations in navigating complex financial landscapes.The importance of finance specialists in strategic financial management lies in their ability to provide tailored advice and insights that drive informed financial decision-making. Pathways to becoming a finance specialist often involve focused education, relevant certifications, and practical experience in the field.

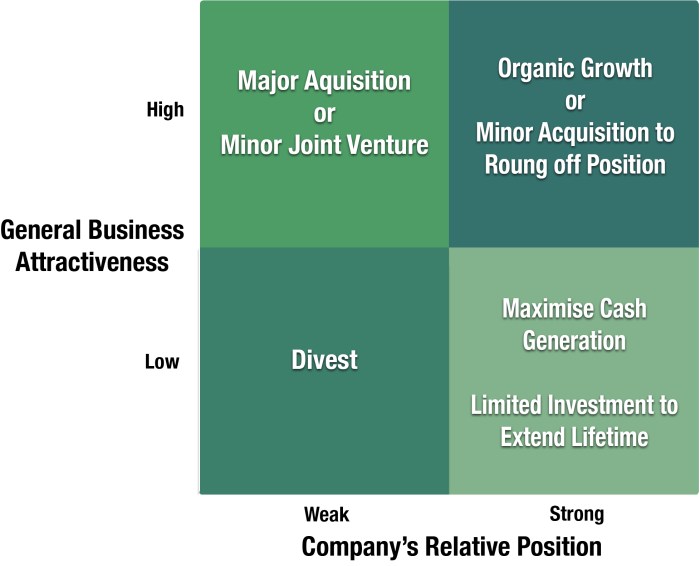

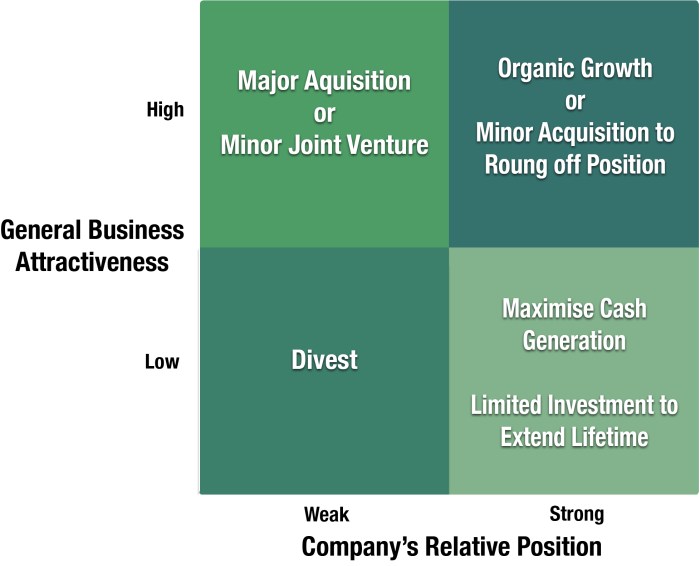

Developing a Finance Strategy

Creating an effective finance strategy involves a structured process that aligns financial objectives with business goals. This process includes conducting a thorough analysis of the current financial landscape and identifying potential growth opportunities.Successful finance strategies often include clear metrics for evaluation, such as return on investment (ROI) and cost-benefit analysis. Organizations that implement well-defined finance strategies are better positioned to navigate financial challenges and capitalize on emerging opportunities.

Final Conclusion

In conclusion, the importance of strategic financial management cannot be overstated; it is essential for businesses aiming to thrive in competitive markets. By leveraging financial strategies and technologies, organizations can position themselves for long-term success and resilience, ultimately achieving their goals and enhancing their market presence.

FAQ Guide

What is the main goal of strategic financial management?

The main goal is to optimize financial resources to achieve long-term organizational objectives and ensure sustainability.

How does finance technology impact strategic financial management?

Finance technology enhances efficiency, provides real-time data for decision-making, and helps organizations stay competitive.

What skills are essential for a finance professional?

Critical thinking, analytical skills, financial literacy, and effective communication are vital for success in finance roles.

Why is financial literacy important in businesses?

Financial literacy empowers employees to make informed decisions, contributing to better financial health and strategic outcomes.

What role do finance specialists play in organizations?

Finance specialists provide expertise in financial analysis, strategy development, and compliance, ensuring effective financial management.